Yes, the 2nd quarter 10-Q was released yesterday. Did it answer all your questions ? You’re not alone !

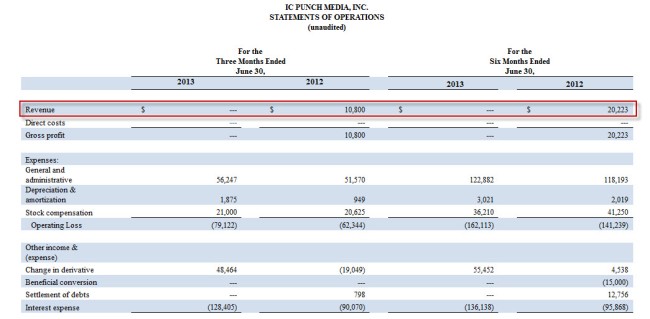

Actually, it seemed to create more questions than answers. The biggest question for most investors is… why is there ZERO revenue listed ??? (see graphic below) It seems inconceivable that not 1 aspect of the company’s operations was able to produce even $1.00 of revenue. Are all the ads seen on the IC Places website non-revenue generating ads ? Are the shows like Hollywood Fast Lane, Travel Tech, etc not producing any revenue at all ? This seems so inconceivable that one wonders where these revenues are being recorded. Hopefully these revenues are being recorded somewhere or the company will have some other issues to deal with. The IRS has no sense of humor about under reporting or not reporting income.

Mr. Samblis appears to address this issue here, where he states that small companies “don’t list individual sources of revenue or liabilities“. OK… that explains why we don’t see how much each of these shows bring in individually… but it does not address why what they do bring in as a total is not listed on the revenue line. On the surface, i.e. lacking a full explanation from Mr. Samblis, either those shows generate NO revenue… or… that revenue is being recorded outside of IC Punch Media on another set of books. And… for those of you thinking (speculating) that the revenue generated from these shows is in the Accounts Receivable line… there was only $3,200.00 listed there. If that is the entirety of revenue generated from those shows (and/or ALL business activities) over 3 months… then it might be time to reevaluate their worthiness to the business.

The next biggest question/concern is the share structure. It seems that in the reporting period of approximately 3 months, the Outstanding Share count increased by some 94-million shares (see below), or, 124-million shares depending on which numbers you look at or calculate on. The 124-million is referenced in this excerpt from the Convertible Notes Payable section: “During the six month period ended June 30, 2013, notes with a face value of $67,500 and penalties in the amount of $16,250 were converted into 124,061,538 shares of common stock.“. (emphasis added) At an average PPS of about .002, that’s about $248,000. or $188,000. dollars of working capital generated for expenses and investments. Many feel that is a lot of cash to burn through without an explanation to the investors as to where its being spent.

(excerpts from most recent quarterly reports)

The number of shares of the issuer’s common stock, par value $.00001 per share, outstanding as of June 4, 2013 was……………….. 2,280,104,697.

The number of shares of the issuer’s common stock, par value $.00001 per share, outstanding as of August 19, 2013………………… 2,375,204,697.

Which leads us into the next biggest concern… no new information being put forth as to the current and future plans and actions of the company. We recently wrote about this here, and there are links in that post about previous posts on the same subject… i.e. this has been an ongoing issue that never seems to get any better. Mr. Samblis has a history of cherry picking the issues he wishes to discuss, and does so on message boards, and occasionally via press releases. He indicated here that he would issue a press release on revenue, however none has been released to date. Revenue is likely the biggest concern to all investors at this point, and not only is there been no revenue projections as promised, we have now seen 2 consecutive quarterly reports listing NO revenues at all.

Mr. Samblis… you can easily calm investors fears by addressing some of the numerous previously posted questions, including the above. Take a peek at the PPS and see if you think doing so is necessary.

Most CEOs of a public company that posted no revenues 2 quarters in a row would be out of a job and someone new would be brought in.

As that isn’t going to happen here it’s hard to figure out why he feels that the very people that have been funding his non revenue producing company are not owed some type of explanation.

LikeLike